| Sum Of All Fears (Time Premium) | |||||||||||||||

Right now there are 136,136,068 open call option contracts across all underlying stocks, ETFs, expirations, and strikes. The sum of all the time premium (not including intrinsic value) in those 136 million contracts is $12,370,031,659.88. That's $12 billion of wasting assets. Of course, 60% of those contracts will be closed prior to expiration, but at least $5 billion willtime decay to zero, and some of that will go to us covered call writers.

| |||||||||||||||

| AAPL Weekly Trade | |||||||||||||||

Followers of our blog know that we've had a good track record of weekly buy-writes on AAPL (24 out of 24 trades closed profitable). We believe this week's pull back is another good entry point.

What has changed in the last few days to justify a 70 point drop from 590-ish to 520-ish? Nothing fundamental to their business. Yes, there are fears of increased competition, but it's mostly a combination of tax-selling (people taking gains this year in advance of feared increases in capital gains rates next year) and margin requirements being increased for some AAPL shareholders.

We believe there is an opportunity this week. For details see our blog article onshort-term buy-write in AAPL.

| |||||||||||||||

| Scanner Nominated Again | |||||||||||||||

Born To Sell's covered call investment tools have been nominated (again!) for a trading software award. Help us win (by voting) and you are automatically entered into a drawing for $10,000 of trading software. Please vote for us in the Trading Software category. We are listed as "Covered Call Investment Tools":

Thanks! And good luck in the $10,000 free drawing!

| |||||||||||||||

| How Professionals Use Options | |||||||||||||||

A recent Options Industry Council article interviewing managers of a $200 million fund on how they use options stated: "(1) we don't own more than 15 names; we know these companies quite well and only deal with names we want to own, (2) if you can write calls 3 or 4 times per year you can increase returns substantially, and (3) we tend to stay within 90 days, and include dividends when we can."

Sounds like a reasonable strategy: Not chasing high flyers, being consistent in their use of options over time, and using relatively short time frames.

| |||||||||||||||

| Buy-Writes By Pension Funds | |||||||||||||||

Pension funds, who have historically been shy about using options, are beginning to see the wisdom, according to an article on MarketsMedia. Not all option strategies are created equal, and the income-generating technique of writing call options against stocks they own has some appeal.

"A buy-write strategy generated about 5-8% more than a long-U.S. equity strategy in 2011, when stocks were highly volatile yet finished roughly flat", according to Phil Gocke of OIC.

Read the full article Pensions Warm Up to Options Slowly.

| |||||||||||||||

| AAPL And 3 Other Covered Calls For Dec 22 Expiration | |||||||||||||||

With just over 2 weeks to go until the December options expire, the top 4 covered calls Born To Sell members have written are (in order of popularity):

(Note: Born To Sell members have access to the full Top 10 Covered Call list, as well as having this list update real-time as members change positions. These are not recommendations, they are merely a reflection of our members' current positions.)

|

Showing posts with label Born To Sell. Show all posts

Showing posts with label Born To Sell. Show all posts

Friday, December 7, 2012

New Born To Sell Newsletter

Below is the most recent Born To Sell Newsletter.

Saturday, November 17, 2012

Born To Sell Article About Time Premium

Here is an article sent to Sell The Call by Born To Sell. It was back in September.

| A Lot Of Time Premium |

Ever wonder how much total time premium is in the market at any given time?

It turns out that right now there are 130,513,596 open call option contracts. The sum of all the time premium in those 130 million contracts is $18,757,615,007.42. That's $18 billion of wasting assets that someone is going to collect (*)!

What does $18B look like? What does $18B look like?

We couldn't find a photo of $18 billion in cash (and, sadly, are a wee bit shy of the $18B needed to take our own photo), but we did find a photo of one billion in cash. You'll just have to imagine 18 times as much as the pile of $100 bills pictured here.

And if you want to see a LOT of cash (like 1000 times as much), check out theTrillion Dollars article from January.

(*) Since 60% of contracts are closed prior to expiration, only 40% of $18B, or roughly $7B is going to time decay to zero between now and expiration. Of course, some contracts will partially decay before being closed, and new contracts will be opened between today and expiration, so it is likely more than $7B of premium will be collected. In any case, it's a big number and you should get your piece by selling some premium!

|

| Five Ways To Increase Portfolio Income |

There are many ways to use covered calls to increase your portfolio's income. Here are five of them:

Any way you do it, you can increase portfolio income and lower portfolio volatility by selling calls on stocks and ETFs you own (or buying stocks just for that purpose).

|

| Free Covered Call Books Giveaway |

Like Born To Sell? Help us get the word out and you could win a free book on covered call investing, or an iTunes gift card:

There are 8 ways to enter (Facebook, Twitter, Google+, etc). Full details on theLink To Us And Win page. Thanks and good luck in the drawings!

|

Thursday, August 2, 2012

August Born To Sell Newsletter

Below is the Born To Sell August newsletter. Topics discussed include retirement calculators, Apple Ex-dividend, and a list of popular covered call trades.

Sell The Call does not have a position in any of the above stocks.

** Disclaimer** - Sell The Call is simply posting information. This is not a recommendation to buy or sell any of the securities above. Do your due diligence before investing as there is risk to all investments. Be sure to Like ourFacebook page, and follow Sell The Call's Twitter and Stocktwits pages.

|

Seller's Paradise Aug 1, 2012 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Sell The Call does not have a position in any of the above stocks.

** Disclaimer** - Sell The Call is simply posting information. This is not a recommendation to buy or sell any of the securities above. Do your due diligence before investing as there is risk to all investments. Be sure to Like ourFacebook page, and follow Sell The Call's Twitter and Stocktwits pages.

Labels:

Apple,

AT and T,

Born To Sell,

Catepillar,

Cisco,

GE,

Intel,

McMoran Exploration,

Microsoft,

Retirement Calculators,

Sell the Call

Tuesday, June 5, 2012

June Born To Sell Newsletter

Here is the June newsletter from Born To Sell:

| Seller's Paradise Jun 1, 2012 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||

Monday, May 7, 2012

May Born To Sell Newsletter

Born To Sell has released its May Newsletter. The information is simply being passed on and is not a recommendation to buy or sell any of the securities mentioned.

| Seller's Paradise May 1, 2012 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Labels:

Apple,

Born To Sell,

Cisco,

covered call,

general electric,

Intel,

Microsoft,

Rocco Pendola,

Sell the Call

Monday, April 16, 2012

April 1 Born To Sell Newsletter

The following Born To Sell newsletter was sent to Sell The Call on April 1st.

Free Money Printing Machine Offer

Free Money Printing Machine Offer

Born To Sell is pleased to announce that every new subscriber will receive a desktop-size money printing machine, for free! In addition, customers who sign up for a full 1-year subscription will receive a free high-speed money printing press:

To get your free money machine, visit the Free Money Machine Offer page.

23 Year Study On BuyWrite Index Performance

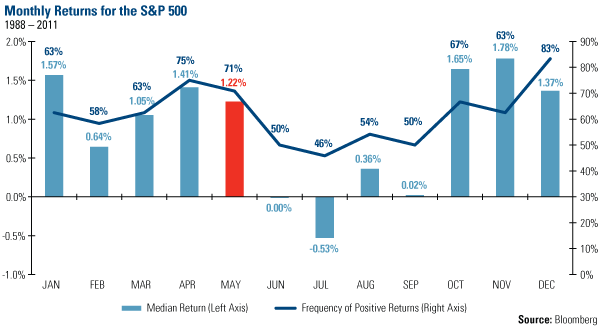

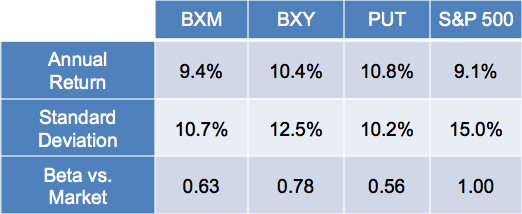

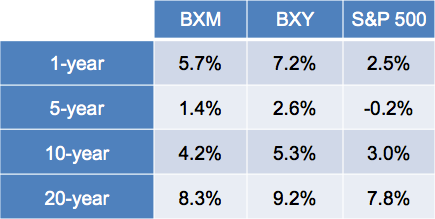

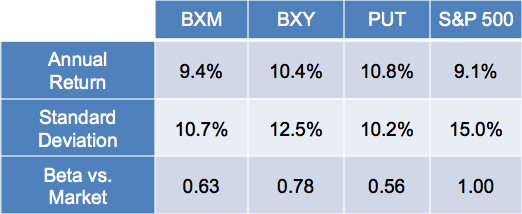

Asset Consulting Group recently released their analysis of 23 years of index option writing. The results show that writing covered calls increases returns and lowers portfolio volatility.

The study looks at several option-writing indices:

- BXM - CBOE S&P 500 BuyWrite Index

writes 1 month ATM (at the money) covered calls on S&P 500 - BXY - CBOE S&P 500 2% OTM BuyWrite Index

writes 1 month 2% OTM (out of the money) covered calls on S&P 500 - PUT - CBOE S&P 500 PutWrite Index

holds T-bills and writes 1 month ATM naked puts on S&P 500

The study then compares those to their benchmark, the S&P 500. In all 3 cases the annual return (from 1988-2011) was higher while the volatility was lower:

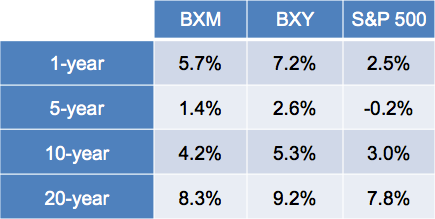

And the covered call indices have higher annual returns over a variety of time frames:

See more data on our blog article BuyWrite Index Performance

Stock Broker Reviews

Barron's has published stock broker reviews for the last 16 years. Every year they offer up their ratings and reviews of top brokers, awarding up to 5 stars in several categories, including:

- Best For Long Term Investing

- Best For Options Traders

- Best For Frequent Traders

And a special section for cost-conscious investors:

- Best Low Cost Brokers For Occasional Traders

- Best Low Cost Brokers For Frequent Traders

You can see the 2011 winners in our blog article Stock Broker Reviews.

VVUS And 3 Other Covered Calls For Apr 21 Expiration

With 3 weeks to go until the Apr options expire, the top 4 covered calls Born To Sell members have written are (in order of popularity):

| Rank | Symbol | Strike |

|---|---|---|

| 1. | VVUS | 20 |

| 2. | GE | 20 |

| 3. | MSFT | 33 |

| 4. | JNJ | 65 |

(Note: Born To Sell members have access to the full Top 10 Covered Call list, as well as having this list update real-time as members change positions. These are not recommendations, they are merely a reflection of our members' current positions.)

INTC And Other Covered Call Watchlist Stocks

Currently, the top 8 stocks Born To Sell members are using for their Watchlist are (in order of popularity):

| Rank | Symbol |

|---|---|

| 1. | INTC |

| 2. | MSFT |

| 3. | T |

| 4. | AAPL |

| 5. | GE |

| 6. | JNJ |

| 7. | CSCO |

| 8. | ABT |

(Note: Born To Sell members have access to the full Top 20 Watchlist, as well as having this list update real-time as members change their watchlists. And, you can have the highest yielding covered calls from your personal watchlist emailed to you after the close each day. Never miss a fat premium from your watchlist again!)

Want More Covered Call Goodness?

Born To Sell is dedicated to only one thing: Making Money With Covered Calls. Our subscribers have access to state-of-the-art covered call screeners and covered call portfolio management tools. For less than the profit of a single trade you could be enjoying recurring monthly income using our tools. Three subscription types to choose from:

| Term | Price |

|---|---|

| Monthly | $59.95 |

| Quarterly | $149.95 (17% discount) |

| Annual | $499.95 (31% discount) |

Plus, all subscriptions begin with a no-obligation 2-week free trial. What are you waiting for? Start collecting premium today!

Happy Trading,

The Born To Sell Team

Follow us: Facebook | Twitter or watch demos of Covered Call Tools (YouTube)

Labels:

Abbot Labs,

Apple,

AT and T,

Born To Sell,

CBOE,

Cisco,

covered call,

covered call trading,

GE,

Intel,

Microsoft,

Sell the Call

Subscribe to:

Posts (Atom)

Retirement calculators can be fun... Just enter some crazy

values and you're an automatic millionaire waiting to happen, enjoying huge

projected withdrawals after an early retirement.

Retirement calculators can be fun... Just enter some crazy

values and you're an automatic millionaire waiting to happen, enjoying huge

projected withdrawals after an early retirement.