There are 13 weeks until the current Alcoa trade ends. The trade is currently Code Yellow. The stock closed the week at $11.57. The Jan 2011 $12.50 call ask price is closed at $0.58.

- Don't forget to visit the web page for Sell The Call, like our Sell The Call Facebook Page and follow our Sell The Call Twitter page!

- This information is not to be used as a recommendation to buy or sell. It is simply information and opinions. Before investing, please consult a financial professional. Sell The Call takes no responsibility for any losses or gains that occur from trades using its material.

- The account does not fully divulge all information (the size of shares bought and calls sold) on open trades. This is for protection of the trade. When the trade on a particular stock ends, the account will give the size information out. Please feel free to ask questions and Sell The Call will answer them the best way possible can without endangering the trade. THE ACCOUNT WILL NOT MISLEAD READERS TO CREATE A GAIN ON ITS TRADES!- If you have any info regarding call selling, be sure to comment or send an email. The goal of the blog is to collaborate so that we all can accumulate wealth with the help of selling calls. Please pass the blog address to others that might find some value from it.

Sunday, October 30, 2011

Friday, October 28, 2011

Alcoa trade now Code Yellow

With yesterday's 7 percent run up, the Alcoa trade is now Code Yellow. This means that the stock is priced above the cost basis of the trade but is still below the strike price. The stock closed yesterday at $11.20. The Jan 2011 $12.50 call ask price closed at $0.45.

- Don't forget to visit the web page for Sell The Call, like our Sell The Call Facebook Page and follow our Sell The Call Twitter page!

- This information is not to be used as a recommendation to buy or sell. It is simply information and opinions. Before investing, please consult a financial professional. Sell The Call takes no responsibility for any losses or gains that occur from trades using its material.

- The account does not fully divulge all information (the size of shares bought and calls sold) on open trades. This is for protection of the trade. When the trade on a particular stock ends, the account will give the size information out. Please feel free to ask questions and Sell The Call will answer them the best way possible can without endangering the trade. THE ACCOUNT WILL NOT MISLEAD READERS TO CREATE A GAIN ON ITS TRADES!- If you have any info regarding call selling, be sure to comment or send an email. The goal of the blog is to collaborate so that we all can accumulate wealth with the help of selling calls. Please pass the blog address to others that might find some value from it.

- Don't forget to visit the web page for Sell The Call, like our Sell The Call Facebook Page and follow our Sell The Call Twitter page!

- This information is not to be used as a recommendation to buy or sell. It is simply information and opinions. Before investing, please consult a financial professional. Sell The Call takes no responsibility for any losses or gains that occur from trades using its material.

- The account does not fully divulge all information (the size of shares bought and calls sold) on open trades. This is for protection of the trade. When the trade on a particular stock ends, the account will give the size information out. Please feel free to ask questions and Sell The Call will answer them the best way possible can without endangering the trade. THE ACCOUNT WILL NOT MISLEAD READERS TO CREATE A GAIN ON ITS TRADES!- If you have any info regarding call selling, be sure to comment or send an email. The goal of the blog is to collaborate so that we all can accumulate wealth with the help of selling calls. Please pass the blog address to others that might find some value from it.

Monday, October 24, 2011

Dividend Payment coming for the first time!

On this journey of making covered call trades to build wealth, Sell The Call had yet to participate in a trade that contains receiving a dividend. That has changed!

Alcoa has a dividend payment scheduled for November. Since Sell The Call made a trade today selling the January $12.50 call, a dividend will be distributed to the account.

- Don't forget to visit the web page for Sell The Call, like our Sell The Call Facebook Page and follow our Sell The Call Twitter page!

- This information is not to be used as a recommendation to buy or sell. It is simply information and opinions. Before investing, please consult a financial professional. Sell The Call takes no responsibility for any losses or gains that occur from trades using its material.

- The account does not fully divulge all information (the size of shares bought and calls sold) on open trades. This is for protection of the trade. When the trade on a particular stock ends, the account will give the size information out. Please feel free to ask questions and Sell The Call will answer them the best way possible can without endangering the trade. THE ACCOUNT WILL NOT MISLEAD READERS TO CREATE A GAIN ON ITS TRADES!

- If you have any info regarding call selling, be sure to comment or send an email. The goal of the blog is to collaborate so that we all can accumulate wealth with the help of selling calls. Please pass the blog address to others that might find some value from it.

Alcoa has a dividend payment scheduled for November. Since Sell The Call made a trade today selling the January $12.50 call, a dividend will be distributed to the account.

- Don't forget to visit the web page for Sell The Call, like our Sell The Call Facebook Page and follow our Sell The Call Twitter page!

- This information is not to be used as a recommendation to buy or sell. It is simply information and opinions. Before investing, please consult a financial professional. Sell The Call takes no responsibility for any losses or gains that occur from trades using its material.

- The account does not fully divulge all information (the size of shares bought and calls sold) on open trades. This is for protection of the trade. When the trade on a particular stock ends, the account will give the size information out. Please feel free to ask questions and Sell The Call will answer them the best way possible can without endangering the trade. THE ACCOUNT WILL NOT MISLEAD READERS TO CREATE A GAIN ON ITS TRADES!

- If you have any info regarding call selling, be sure to comment or send an email. The goal of the blog is to collaborate so that we all can accumulate wealth with the help of selling calls. Please pass the blog address to others that might find some value from it.

New Trade in Alcoa!

Sell The Call has sold the January 2011 $12.50 call for Alcoa. It is Sell The Call's third trade in Alcoa. There are three aspects to the trade that have not happened before this trade. There is a scheduled dividend issued during the trade and there is an increase in the strike price (from $12.00 to $12.50). Sell The Call also went out three months (January) for this trade as the November and December $12.00 calls did not carry enough value to trade.

- Don't forget to visit the web page for Sell The Call, like our Sell The Call Facebook Page and follow our Sell The Call Twitter page!

- This information is not to be used as a recommendation to buy or sell. It is simply information and opinions. Before investing, please consult a financial professional. Sell The Call takes no responsibility for any losses or gains that occur from trades using its material.

- The account does not fully divulge all information (the size of shares bought and calls sold) on open trades. This is for protection of the trade. When the trade on a particular stock ends, the account will give the size information out. Please feel free to ask questions and Sell The Call will answer them the best way possible can without endangering the trade. THE ACCOUNT WILL NOT MISLEAD READERS TO CREATE A GAIN ON ITS TRADES!

- If you have any info regarding call selling, be sure to comment or send an email. The goal of the blog is to collaborate so that we all can accumulate wealth with the help of selling calls. Please pass the blog address to others that might find some value from it.

- Don't forget to visit the web page for Sell The Call, like our Sell The Call Facebook Page and follow our Sell The Call Twitter page!

- This information is not to be used as a recommendation to buy or sell. It is simply information and opinions. Before investing, please consult a financial professional. Sell The Call takes no responsibility for any losses or gains that occur from trades using its material.

- The account does not fully divulge all information (the size of shares bought and calls sold) on open trades. This is for protection of the trade. When the trade on a particular stock ends, the account will give the size information out. Please feel free to ask questions and Sell The Call will answer them the best way possible can without endangering the trade. THE ACCOUNT WILL NOT MISLEAD READERS TO CREATE A GAIN ON ITS TRADES!

- If you have any info regarding call selling, be sure to comment or send an email. The goal of the blog is to collaborate so that we all can accumulate wealth with the help of selling calls. Please pass the blog address to others that might find some value from it.

Friday, October 21, 2011

Current Alcoa trade ends Code Orange

The current Alcoa trade ended this week with the stock closing at $10.20 and the Oct $12.00 call expiring worthless. Sell The Call still owns its shares and will look to sell another call. For the first time in Sell The Call's trading history, the next trade will also include a dividend payment. The market had a positive week. The European meeting starting on Sunday should set the focus

Sell The Call is looking to sell either the December $12.00 call or the January $12.50 call. The decision will be made once the December options are reported. The European meeting on Sunday should also help set the tone for Monday.

Sell The Call is looking to sell either the December $12.00 call or the January $12.50 call. The decision will be made once the December options are reported. The European meeting on Sunday should also help set the tone for Monday.

Friday, October 14, 2011

1 week remaining on current Alcoa trade Code Orange

There is one week remaining on the current Alcoa trade. It is currently Code Orange. The stock closed at $10.26. That is a rise of $0.55 from last week. The Oct $12.00 call ask price closed at $0.02. That is a decline of $0.06 from last week.

Sell The Call expects to see the call expire worthless next Friday. The next option is to sell another $12.00 call with the time frame depending on what the price of the stock is when the trade is made. As of right now, the November $12.00 call does not carry enough value. Sell The Call is currently looking at the December $12.00 call or the January $12.50 call.

- Don't forget to visit the web page for Sell The Call, like our Sell The Call Facebook Page and follow our Sell The Call Twitter page!

- This information is not to be used as a recommendation to buy or sell. It is simply information and opinions. Before investing, please consult a financial professional. Sell The Call takes no responsibility for any losses or gains that occur from trades using its material.

- The account does not fully divulge all information (the size of shares bought and calls sold) on open trades. This is for protection of the trade. When the trade on a particular stock ends, the account will give the size information out. Please feel free to ask questions and Sell The Call will answer them the best way possible can without endangering the trade. THE ACCOUNT WILL NOT MISLEAD READERS TO CREATE A GAIN ON ITS TRADES!

- If you have any info regarding call selling, be sure to comment or send an email. The goal of the blog is to collaborate so that we all can accumulate wealth with the help of selling calls. Please pass the blog address to others that might find some value from it.

Sell The Call expects to see the call expire worthless next Friday. The next option is to sell another $12.00 call with the time frame depending on what the price of the stock is when the trade is made. As of right now, the November $12.00 call does not carry enough value. Sell The Call is currently looking at the December $12.00 call or the January $12.50 call.

- Don't forget to visit the web page for Sell The Call, like our Sell The Call Facebook Page and follow our Sell The Call Twitter page!

- This information is not to be used as a recommendation to buy or sell. It is simply information and opinions. Before investing, please consult a financial professional. Sell The Call takes no responsibility for any losses or gains that occur from trades using its material.

- The account does not fully divulge all information (the size of shares bought and calls sold) on open trades. This is for protection of the trade. When the trade on a particular stock ends, the account will give the size information out. Please feel free to ask questions and Sell The Call will answer them the best way possible can without endangering the trade. THE ACCOUNT WILL NOT MISLEAD READERS TO CREATE A GAIN ON ITS TRADES!

- If you have any info regarding call selling, be sure to comment or send an email. The goal of the blog is to collaborate so that we all can accumulate wealth with the help of selling calls. Please pass the blog address to others that might find some value from it.

Sunday, October 9, 2011

Early Assignment question/discussion

Hey

In June of this year, Sell The Call had a covered call trade in Zagg end early due to early assignment. Sell The Call wants to know the following:

Is there a way to find out the ratio of in the money calls that end up getting assigned early?

How does the depth of the call strike price affect the probability of being assigned early?

In June of this year, Sell The Call had a covered call trade in Zagg end early due to early assignment. Sell The Call wants to know the following:

Is there a way to find out the ratio of in the money calls that end up getting assigned early?

How does the depth of the call strike price affect the probability of being assigned early?

Friday, October 7, 2011

2 weeks until current Alcoa trade expires Code Orange

There are two weeks remaining on the current Alcoa trade. The trade is currently Code Orange. The stock closed the week at $9.71. That is a rise of $0.14. The Oct $12.00 call ask price closed at $0.08. There was no change from last week.

- Don't forget to visit the web page for Sell The Call, like our Sell The Call Facebook Page and follow our Sell The Call Twitter page!

- This information is not to be used as a recommendation to buy or sell. It is simply information and opinions. Before investing, please consult a financial professional. Sell The Call takes no responsibility for any losses or gains that occur from trades using its material.

- The account does not fully divulge all information (the size of shares bought and calls sold) on open trades. This is for protection of the trade. When the trade on a particular stock ends, the account will give the size information out. Please feel free to ask questions and Sell The Call will answer them the best way possible can without endangering the trade. THE ACCOUNT WILL NOT MISLEAD READERS TO CREATE A GAIN ON ITS TRADES!

- If you have any info regarding call selling, be sure to comment or send an email. The goal of the blog is to collaborate so that we all can accumulate wealth with the help of selling calls. Please pass the blog address to others that might find some value from it.

- Don't forget to visit the web page for Sell The Call, like our Sell The Call Facebook Page and follow our Sell The Call Twitter page!

- This information is not to be used as a recommendation to buy or sell. It is simply information and opinions. Before investing, please consult a financial professional. Sell The Call takes no responsibility for any losses or gains that occur from trades using its material.

- The account does not fully divulge all information (the size of shares bought and calls sold) on open trades. This is for protection of the trade. When the trade on a particular stock ends, the account will give the size information out. Please feel free to ask questions and Sell The Call will answer them the best way possible can without endangering the trade. THE ACCOUNT WILL NOT MISLEAD READERS TO CREATE A GAIN ON ITS TRADES!

- If you have any info regarding call selling, be sure to comment or send an email. The goal of the blog is to collaborate so that we all can accumulate wealth with the help of selling calls. Please pass the blog address to others that might find some value from it.

Thursday, October 6, 2011

Oct 6 Born To Sell Newsletter

Here is the latest edition of the Born To Sell newsletter.

| New Money Making Guide | ||||||||||||||||||

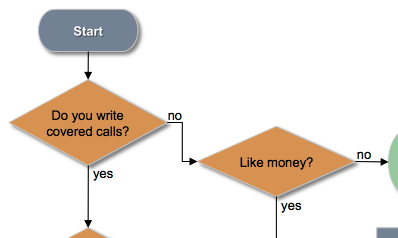

In case you need a break from daily triple digit losses in the DJIA, our marketing department has come up with the definitive guide on how to make money in the stock market, presented in an easy step-by-step flow chart: To see the full flow chart check out our Money Making Guide (humor). | ||||||||||||||||||

| Call Premium Fortune | ||||||||||||||||||

Albert Einstein is rumored to have said that compound interest is the greatest invention in human history. Even a relatively modest return of 1% per month can make you rich if compounded over a long enough period of time. Covered call investing is not a get-rich-quick strategy. It is a game of patience, and it rewards the patient. You can double your money in 5.8 years if you can get 1%/month (or in only 3 years if you can get 2%/month). You can quadruple your money in as little as 11.7 years at 1%/month. The key is to target a bit more than 1% per month (maybe 1.3%/month) so that if you miss a month or two, the other months will make up for it. We discuss this concept in our blog article on Compound Interest. | ||||||||||||||||||

| Which Expiration Date Should You Write? | ||||||||||||||||||

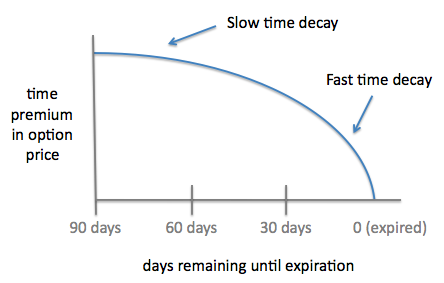

Everyone knows time decay in options is non-linear. Which is why most people targeting income from selling options choose to sell near month options: But there are other considerations when choosing which option to write, including volatility, downside protection, and taxes. See our blog article onTime Decay In Options. | ||||||||||||||||||

| Master Limited Partnerships | ||||||||||||||||||

MLPs pay high dividends and offer pass-through tax deductions. As long as they are generating enough cash to cover their dividend payouts, they can make good covered call candidates since the high dividend yield acts as a natural break on price declines. To see some example MLPs that pay over 5% dividend and have the cash flow to cover it, check out Master Limited Partnership Covered Calls. | ||||||||||||||||||

| T And 3 Other Covered Calls For Oct 22 Expiration | ||||||||||||||||||

With just over 3 weeks to go until the Oct options expire, the top 4 covered calls Born To Sell members have written are (in order of popularity):

(Note: Born To Sell members have access to the full Top 10 Covered Call list, as well as having this list update real-time as members change positions. These are not recommendations, they are merely a reflection of our members' current positions.) | ||||||||||||||||||

| INTC And Other Covered Call Watchlist Stocks | ||||||||||||||||||

Currently, the top 8 stocks Born To Sell members are using for their Watchlist are (in order of popularity):

(Note: Born To Sell members have access to the full Top 20 Watchlist, as well as having this list update real-time as members change their watchlists. And, you can have the highest yielding covered calls from your personal watchlist emailed to you after the close each day. Never miss a fat premium from your watchlist again!) | ||||||||||||||||||

| Want More Covered Call Goodness? | ||||||||||||||||||

Born To Sell is dedicated to only one thing: Making Money With Covered Calls. Our subscribers have access to state-of-the-art covered call screeners and covered call portfolio management tools. For less than the profit of a single trade you could be enjoying recurring monthly income using our tools. Three subscription types to choose from:

Plus, all subscriptions begin with a no-obligation 2-week free trial. What are you waiting for? Start collecting premium today! Happy Trading, The Born To Sell Team |

Monday, October 3, 2011

3 weeks left on current Alcoa trade Code Orange

There are three weeks left on the current Alcoa trade. The trade status is now Code Orange. The stock closed the week at $9.57. That is a decline of $0.50. The Oct $12.00 call ask price is now at $0.08. That is a decline of $0.08.

- Don't forget to visit the web page for Sell The Call, like our Sell The Call Facebook Page and follow our Sell The Call Twitter page!

- This information is not to be used as a recommendation to buy or sell. It is simply information and opinions. Before investing, please consult a financial professional. Sell The Call takes no responsibility for any losses or gains that occur from trades using its material.

- The account does not fully divulge all information (the size of shares bought and calls sold) on open trades. This is for protection of the trade. When the trade on a particular stock ends, the account will give the size information out. Please feel free to ask questions and Sell The Call will answer them the best way possible can without endangering the trade. THE ACCOUNT WILL NOT MISLEAD READERS TO CREATE A GAIN ON ITS TRADES!

- If you have any info regarding call selling, be sure to comment or send an email. The goal of the blog is to collaborate so that we all can accumulate wealth with the help of selling calls. Please pass the blog address to others that might find some value from it.

- Don't forget to visit the web page for Sell The Call, like our Sell The Call Facebook Page and follow our Sell The Call Twitter page!

- This information is not to be used as a recommendation to buy or sell. It is simply information and opinions. Before investing, please consult a financial professional. Sell The Call takes no responsibility for any losses or gains that occur from trades using its material.

- The account does not fully divulge all information (the size of shares bought and calls sold) on open trades. This is for protection of the trade. When the trade on a particular stock ends, the account will give the size information out. Please feel free to ask questions and Sell The Call will answer them the best way possible can without endangering the trade. THE ACCOUNT WILL NOT MISLEAD READERS TO CREATE A GAIN ON ITS TRADES!

- If you have any info regarding call selling, be sure to comment or send an email. The goal of the blog is to collaborate so that we all can accumulate wealth with the help of selling calls. Please pass the blog address to others that might find some value from it.

Subscribe to:

Posts (Atom)