There are three weeks left on the OCZ trade. The trade is currently Code Yellow. The stock has closed the week at $5.95. That is a price rise of $0.25 since Sell The Call put on the trade. The May $6.00 call ask price closed at $0.70. That is a price rise of $0.30 since the trade was put on.

** Disclaimer** - Sell The Call is simply posting information. This is not a recommendation to buy or sell any of the securities above. Do your due diligence before investing as there is risk to all investments. Don't forget to Like ourFacebook page, and follow Sell The Call's Twitter and Stocktwits pages.

Friday, April 27, 2012

Wednesday, April 25, 2012

Seeking Alpha article on Covered Call Strategy (April 24)

Seeking Alpha published the following articles (April 24) on covered call strategy:

Allan Ellman - Covered Call Writing: The Significance of Volume and Open Interest : MELI

** Disclaimer** - Sell The Call is simply posting information. This is not a recommendation to buy or sell any of the securities above. Do your due diligence before investing as there is risk to all investments. Don't forget to Like ourFacebook page, and follow Sell The Call's Twitter and Stocktwits pages.

Allan Ellman - Covered Call Writing: The Significance of Volume and Open Interest : MELI

** Disclaimer** - Sell The Call is simply posting information. This is not a recommendation to buy or sell any of the securities above. Do your due diligence before investing as there is risk to all investments. Don't forget to Like ourFacebook page, and follow Sell The Call's Twitter and Stocktwits pages.

Tuesday, April 24, 2012

New covered call trade in OCZ Tech Group

Sell The Call has made a new covered call trade in OCZ Technology Group (OCZ). The shares were purchased for $5.70. The May $6.00 calls sold for $0.40. The trade will expire on May 18, 2012.

** Disclaimer** - Sell The Call is simply posting information. This is not a recommendation to buy or sell any of the securities above. Do your due diligence before investing as there is risk to all investments. Don't forget to Like ourFacebook page, and follow Sell The Call's Twitter and Stocktwits pages.

** Disclaimer** - Sell The Call is simply posting information. This is not a recommendation to buy or sell any of the securities above. Do your due diligence before investing as there is risk to all investments. Don't forget to Like ourFacebook page, and follow Sell The Call's Twitter and Stocktwits pages.

Monday, April 23, 2012

Charles Schwab's OnInvesting article on Covered Calls

In the April issue of OnInvesting, Charles Schwab's Investment Magazine, there is an article on Covered Calls by Randy Frederick. The link is below.

Randy Frederick - Options Strategies For A Flat Market

** Disclaimer** - Sell The Call is simply posting information. This is not a recommendation to buy or sell any of the securities above. Do your due diligence before investing as there is risk to all investments. Don't forget to Like ourFacebook page, and follow Sell The Call's Twitter and Stocktwits pages.

Randy Frederick - Options Strategies For A Flat Market

** Disclaimer** - Sell The Call is simply posting information. This is not a recommendation to buy or sell any of the securities above. Do your due diligence before investing as there is risk to all investments. Don't forget to Like ourFacebook page, and follow Sell The Call's Twitter and Stocktwits pages.

Friday, April 20, 2012

Current Alcoa trade ends Code Orange

The current Alcoa trade has ended. The status is Code Orange. The stock closed the week at $9.69.

Sell The Call will be going back into the options market and sell another call on its Alcoa stock.

** Disclaimer** - Sell The Call is simply posting information. This is not a recommendation to buy or sell any of the securities above. Do your due diligence before investing as there is risk to all investments. Don't forget to Like ourFacebook page, and follow Sell The Call's Twitter and Stocktwits pages.

Sell The Call will be going back into the options market and sell another call on its Alcoa stock.

** Disclaimer** - Sell The Call is simply posting information. This is not a recommendation to buy or sell any of the securities above. Do your due diligence before investing as there is risk to all investments. Don't forget to Like ourFacebook page, and follow Sell The Call's Twitter and Stocktwits pages.

Monday, April 16, 2012

April 1 Born To Sell Newsletter

The following Born To Sell newsletter was sent to Sell The Call on April 1st.

Free Money Printing Machine Offer

Free Money Printing Machine Offer

Born To Sell is pleased to announce that every new subscriber will receive a desktop-size money printing machine, for free! In addition, customers who sign up for a full 1-year subscription will receive a free high-speed money printing press:

To get your free money machine, visit the Free Money Machine Offer page.

23 Year Study On BuyWrite Index Performance

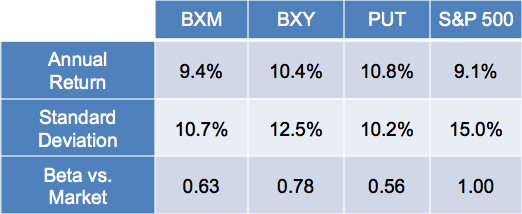

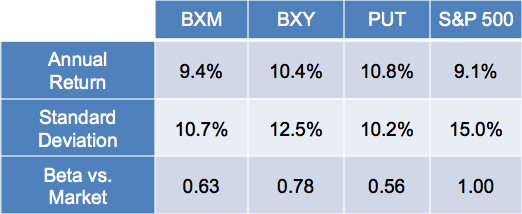

Asset Consulting Group recently released their analysis of 23 years of index option writing. The results show that writing covered calls increases returns and lowers portfolio volatility.

The study looks at several option-writing indices:

- BXM - CBOE S&P 500 BuyWrite Index

writes 1 month ATM (at the money) covered calls on S&P 500 - BXY - CBOE S&P 500 2% OTM BuyWrite Index

writes 1 month 2% OTM (out of the money) covered calls on S&P 500 - PUT - CBOE S&P 500 PutWrite Index

holds T-bills and writes 1 month ATM naked puts on S&P 500

The study then compares those to their benchmark, the S&P 500. In all 3 cases the annual return (from 1988-2011) was higher while the volatility was lower:

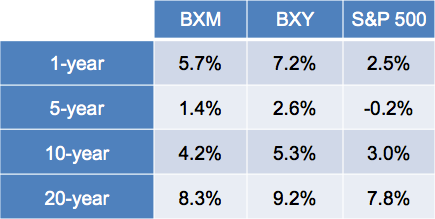

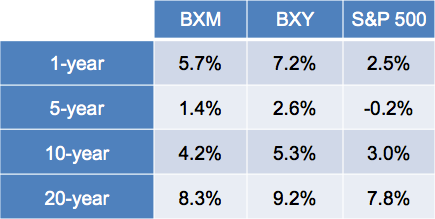

And the covered call indices have higher annual returns over a variety of time frames:

See more data on our blog article BuyWrite Index Performance

Stock Broker Reviews

Barron's has published stock broker reviews for the last 16 years. Every year they offer up their ratings and reviews of top brokers, awarding up to 5 stars in several categories, including:

- Best For Long Term Investing

- Best For Options Traders

- Best For Frequent Traders

And a special section for cost-conscious investors:

- Best Low Cost Brokers For Occasional Traders

- Best Low Cost Brokers For Frequent Traders

You can see the 2011 winners in our blog article Stock Broker Reviews.

VVUS And 3 Other Covered Calls For Apr 21 Expiration

With 3 weeks to go until the Apr options expire, the top 4 covered calls Born To Sell members have written are (in order of popularity):

| Rank | Symbol | Strike |

|---|---|---|

| 1. | VVUS | 20 |

| 2. | GE | 20 |

| 3. | MSFT | 33 |

| 4. | JNJ | 65 |

(Note: Born To Sell members have access to the full Top 10 Covered Call list, as well as having this list update real-time as members change positions. These are not recommendations, they are merely a reflection of our members' current positions.)

INTC And Other Covered Call Watchlist Stocks

Currently, the top 8 stocks Born To Sell members are using for their Watchlist are (in order of popularity):

| Rank | Symbol |

|---|---|

| 1. | INTC |

| 2. | MSFT |

| 3. | T |

| 4. | AAPL |

| 5. | GE |

| 6. | JNJ |

| 7. | CSCO |

| 8. | ABT |

(Note: Born To Sell members have access to the full Top 20 Watchlist, as well as having this list update real-time as members change their watchlists. And, you can have the highest yielding covered calls from your personal watchlist emailed to you after the close each day. Never miss a fat premium from your watchlist again!)

Want More Covered Call Goodness?

Born To Sell is dedicated to only one thing: Making Money With Covered Calls. Our subscribers have access to state-of-the-art covered call screeners and covered call portfolio management tools. For less than the profit of a single trade you could be enjoying recurring monthly income using our tools. Three subscription types to choose from:

| Term | Price |

|---|---|

| Monthly | $59.95 |

| Quarterly | $149.95 (17% discount) |

| Annual | $499.95 (31% discount) |

Plus, all subscriptions begin with a no-obligation 2-week free trial. What are you waiting for? Start collecting premium today!

Happy Trading,

The Born To Sell Team

Follow us: Facebook | Twitter or watch demos of Covered Call Tools (YouTube)

Labels:

Abbot Labs,

Apple,

AT and T,

Born To Sell,

CBOE,

Cisco,

covered call,

covered call trading,

GE,

Intel,

Microsoft,

Sell the Call

1 week left until current Alcoa trade ends

There is one week left until the current Alcoa trade ends. The trade's status is currently Code Orange. The stock closed the week at $ 9.85. That is a $0.22 increase from last week. The April $11.00 call ask price closed at $0.01. That is a decline of $0.01 from last week.

** Disclaimer** - Sell The Call is simply posting information. This is not a recommendation to buy or sell any of the securities above. Do your due diligence before investing as there is risk to all investments. Don't forget to Like our Facebook page, and follow Sell The Call's Twitter and Stocktwits pages.

** Disclaimer** - Sell The Call is simply posting information. This is not a recommendation to buy or sell any of the securities above. Do your due diligence before investing as there is risk to all investments. Don't forget to Like our Facebook page, and follow Sell The Call's Twitter and Stocktwits pages.

Tuesday, April 10, 2012

Seeking Alpha articles on Covered Call Strategy (April 1-7)

Links to the following Seeking Alpha articles that were written on the Covered Call Strategy between April 1 and April 7 of 2012 are posted below.

April 2

Allan Ellman - Covered Call Writing And The Out Of The Money Strike

Sol Palha - Benefits Of A Covered Write Strategy - SDRL

April 6

Michael Thomsett - Options Foward Rolling - Good, Bad, or Ugly: RIMM, M

** Disclaimer** - Sell The Call is simply posting information. This is not a recommendation to buy or sell any of the securities above. Do your due diligence before investing as there is risk to all investments.

April 2

Allan Ellman - Covered Call Writing And The Out Of The Money Strike

Sol Palha - Benefits Of A Covered Write Strategy - SDRL

April 6

Michael Thomsett - Options Foward Rolling - Good, Bad, or Ugly: RIMM, M

** Disclaimer** - Sell The Call is simply posting information. This is not a recommendation to buy or sell any of the securities above. Do your due diligence before investing as there is risk to all investments.

Labels:

Allan Ellman,

covered call,

covered call trading,

M,

Michael Thomsett,

RIMM,

SDRL,

Seeking Alpha,

Sell the Call,

Sol Palha

Friday, April 6, 2012

2 weeks until current Alcoa trade expires Code Orange

There are 2 weeks remaining on the current Alcoa trade. The trade is currently Code Orange. The stock closed the week at $9.63. That is a decline of $0.39. The April $11.00 call ask price closed the week at $0.04. That is a decline of $0.05 for the week.

** Disclaimer** - Sell The Call is simply posting information. This is not a recommendation to buy or sell any of the securities above. Do your due diligence before investing as there is risk to all investments.

** Disclaimer** - Sell The Call is simply posting information. This is not a recommendation to buy or sell any of the securities above. Do your due diligence before investing as there is risk to all investments.

Subscribe to:

Posts (Atom)