Increased Returns With Less Volatility

The Wall Street Journal ran an article in early December showing the benefits of covered calls. It states:

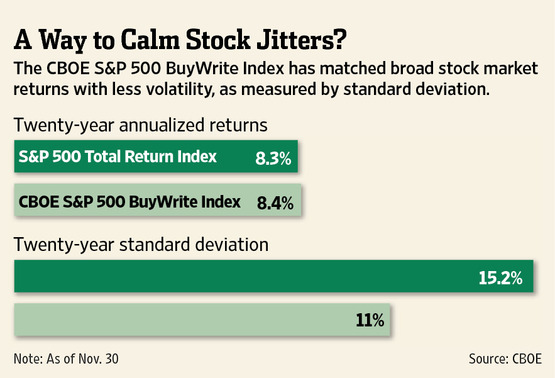

"There is one way to steady a stock portfolio without unloading shares, however: an options strategy known as "covered calls." The idea is to collect extra income now in exchange for giving up potential gains later."

The article included this graphic to make its point about lower volatility:

To read the full artilce, see Options for Nervous Investors on WSJ.com.

Barron's Likes Covered CallsA recent article in Barron's points out what a winning strategy covered calls have been: "The simple strategy known as the "buy-write" or "covered call" was proven in 2011 to make a silk purse from a sow's ear. In 2011, when the Standard & Poor's 500 Index exhibited tremendous volatility, only to finish the year at roughly the same place that it began, the Chicago Board Options Exchange's BuyWrite Index (BXM) rose 5.7%."

It is also worth pointing out what they said about Born To Sell a few months ago: "A terrific tool for those who generate income by selling calls against existing positions. Born To Sell gives covered call traders some great ideas."

To read the full articles, see Buy-Write Is the Right Buy and Two New Ways to Make Money on Barrons.com.

Diversifying With Healthcare StocksHealthcare stocks represent 10% of the S&P 500. Assuming you don't over-weight or under-weight the sector, they should make up around 10% of your portfolio. The good news is that many of them are large cap dividend payers, which is a category that many covered call investors enjoy. For some ideas, see our article on healthcare stocks for covered calls.

Ford DividendFord Motor canceled its dividend in 2006 as it restructured itself. Now, five years later, Ford will pay a dividend of 5 cents per share with an ex-dividend date of January 27, 2012.

Ford does not yet have an investment grade debt rating, which prevents many institutional funds from owning the stock. But once Ford attains an investment grade rating there could be institutional demand for the shares that is missing today.

For some example covered calls on how to trade Ford, see our blog article onFord dividends.

Win $10,000 Of Trading SoftwareBAC And 3 Other Covered Calls For Jan 21 ExpirationBorn To Sell has been nominated for a trading software award! By voting you are automatically entered into a drawing for $10,000 of trading software. If you like our tools or site, please vote for usbefore January 31st in theAfter you click the link, scroll down to the Trading Software category and we are listed as "Covered Call Investment Tools".Thanks! And good luck in the free drawing!

With just over 3 weeks to go until the Jan options expire, the top 4 covered calls Born To Sell members have written are (in order of popularity):

| Rank | Symbol | Strike |

|---|---|---|

| 1. | BAC | 6 |

| 2. | MSFT | 27.5 |

| 3. | INTC | 24 |

| 4. | X | 26 |

(Note: Born To Sell members have access to the full Top 10 Covered Call list, as well as having this list update real-time as members change positions. These are not recommendations, they are merely a reflection of our members' current positions.)

INTC And Other Covered Call Watchlist StocksCurrently, the top 8 stocks Born To Sell members are using for their Watchlist are (in order of popularity):

| Rank | Symbol |

|---|---|

| 1. | INTC |

| 2. | MSFT |

| 3. | T |

| 4. | AAPL |

| 5. | F |

| 6. | GE |

| 7. | VZ |

| 8. | BAC |

(Note: Born To Sell members have access to the full Top 20 Watchlist, as well as having this list update real-time as members change their watchlists. And, you can have the highest yielding covered calls from your personal watchlist emailed to you after the close each day. Never miss a fat premium from your watchlist again!)

Want More Covered Call Goodness?Born To Sell is dedicated to only one thing: Making Money With Covered Calls. Our subscribers have access to state-of-the-art covered call screeners and covered call portfolio management tools. For less than the profit of a single trade you could be enjoying recurring monthly income using our tools. Three subscription types to choose from:

| Term | Price |

|---|---|

| Monthly | $59.95 |

| Quarterly | $149.95 (17% discount) |

| Annual | $499.95 (31% discount) |

Plus, all subscriptions begin with a no-obligation 2-week free trial. What are you waiting for? Start collecting premium today!

Happy Trading,

The Born To Sell Team

Follow us: Facebook | Twitter or see Demos Of Covered Call Tools (YouTube)

No comments:

Post a Comment